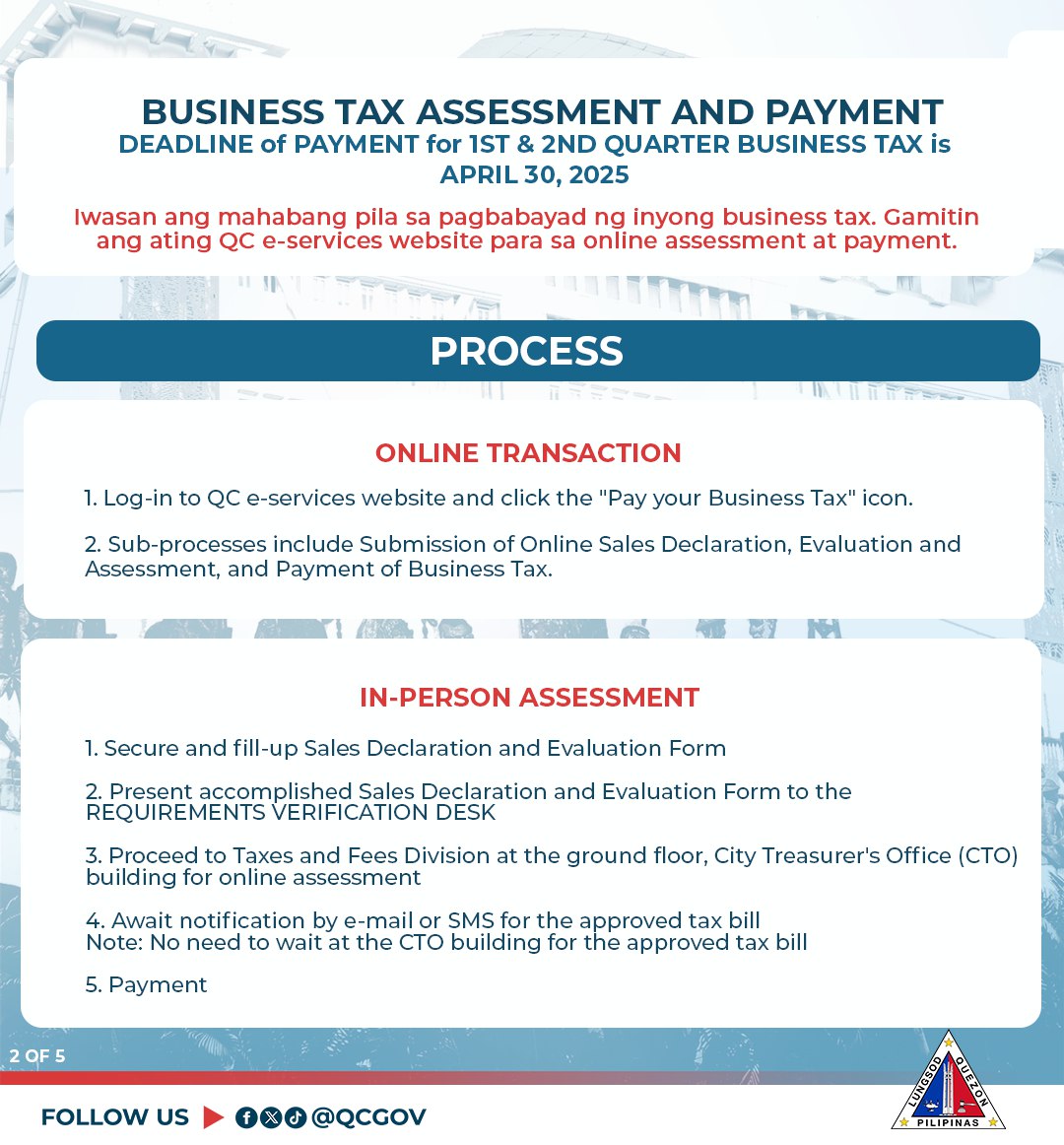

QCitizens, iwasan ang mahabang pila sa pagbabayad ng inyong business tax!

Gamitin ang ating QC E-SERVICES website para sa ONLINE ASSESSMENT at PAYMENT.

Mag-log in lamang sa inyong account sa QC e-services (https://qceservices.quezoncity.gov.ph/) at hanapin ang icon para sa BUSINESS TAX.

Maaari ring magtungo sa City Hall para sa in-person transaction.

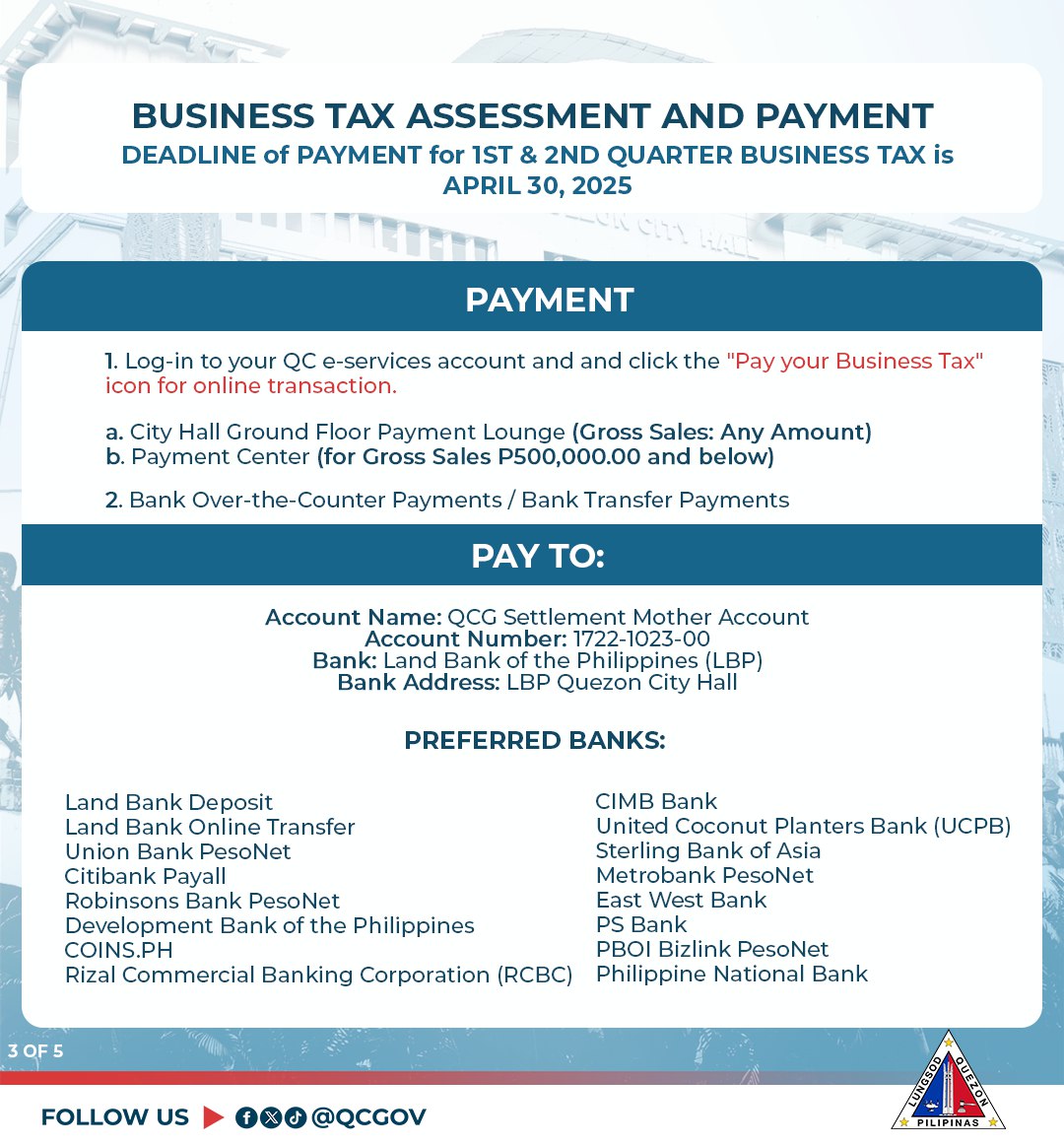

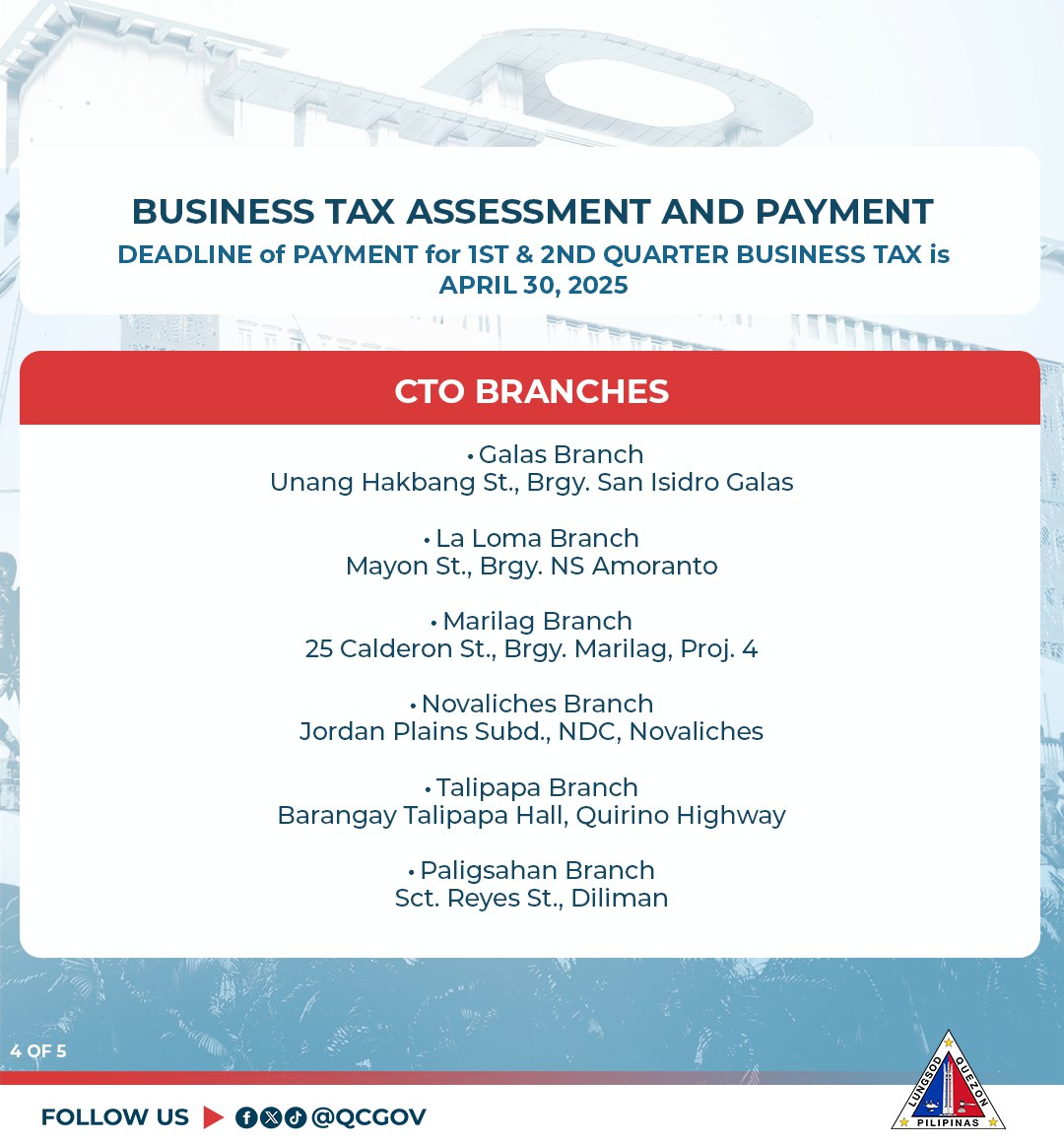

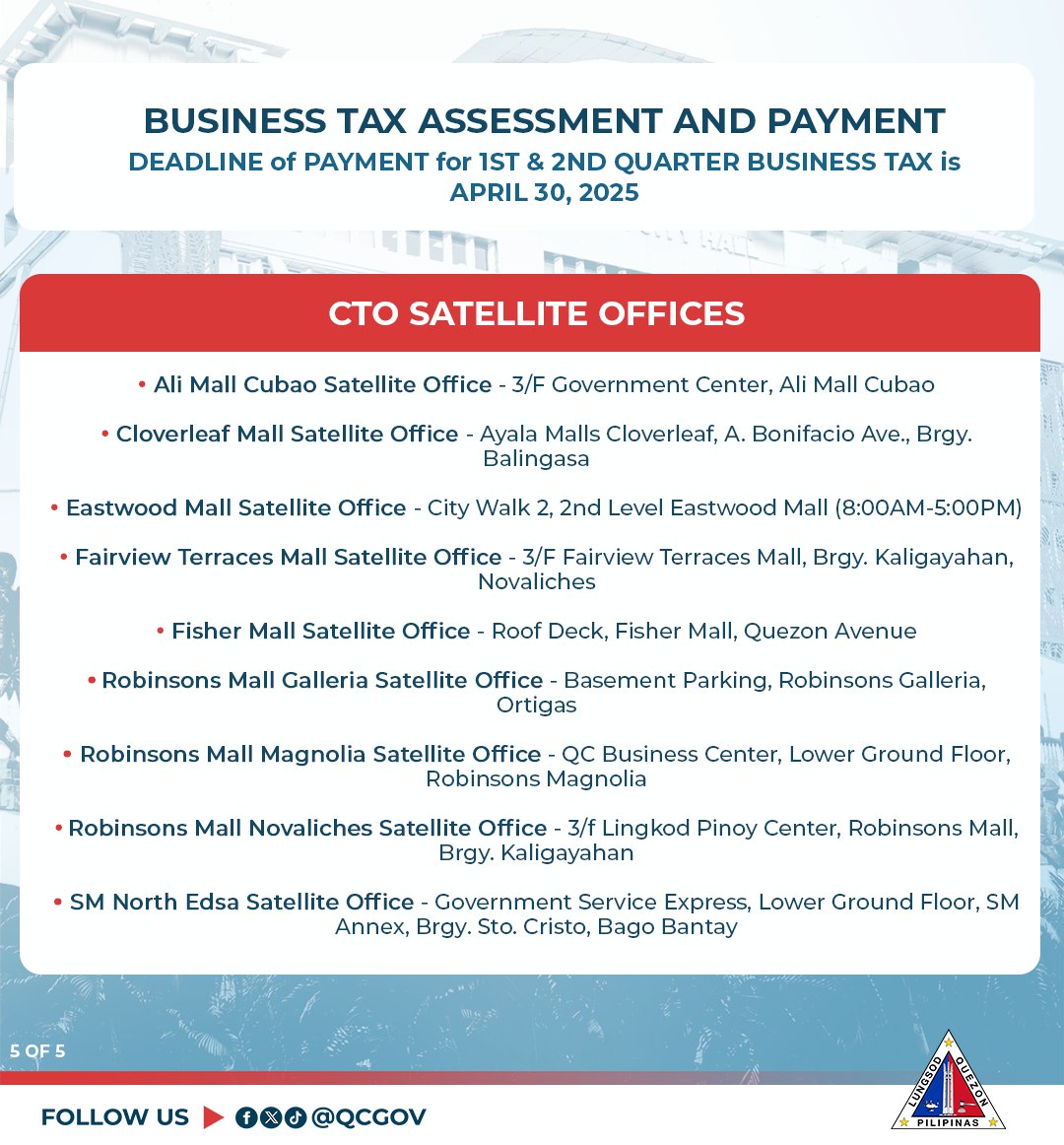

Maaari namang magbayad ng business tax sa mga bangko o sa City Treasurer’s Office branches at satellite offices.

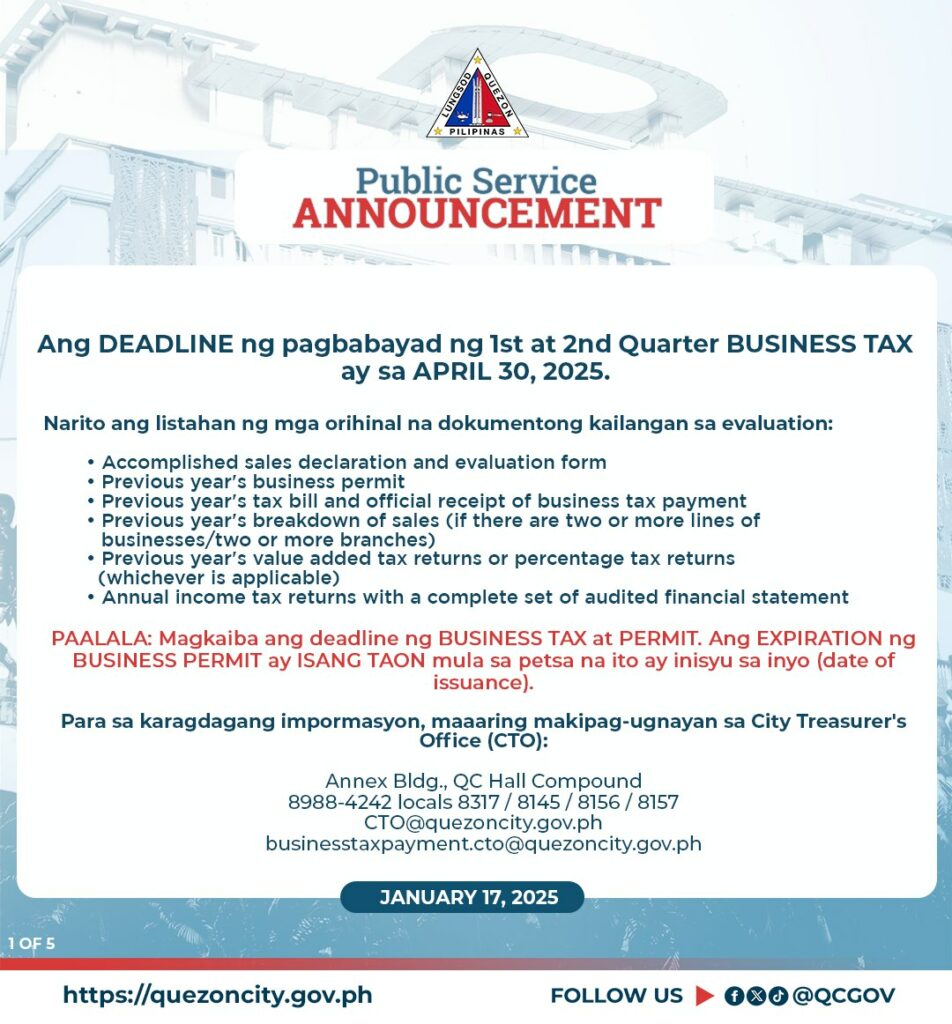

Narito ang listahan ng mga orihinal na dokumentong kailangan sa evaluation:

![]() Accomplished sales declaration and evaluation form

Accomplished sales declaration and evaluation form

![]() Previous year’s business permit

Previous year’s business permit

![]() Previous year’s tax bill and official receipt of business tax payment

Previous year’s tax bill and official receipt of business tax payment

![]() Previous year’s breakdown of sales (if there are two or more lines of businesses/two or more branches)

Previous year’s breakdown of sales (if there are two or more lines of businesses/two or more branches)

![]() Previous year’s value added tax returns or percentage tax returns (whichever is applicable)

Previous year’s value added tax returns or percentage tax returns (whichever is applicable)

![]() Annual income tax returns with a complete set of audited financial statement

Annual income tax returns with a complete set of audited financial statement

Para sa karagdagang impormasyon, maaaring makipag-ugnayan sa CITY TREASURER’S OFFICE (CTO):

Annex Building, QC Hall Compound

8988-4242 locals 8317 / 8145 / 8156 / 8157

CTO@quezoncity.gov.ph; businesstaxpayment.cto@quezoncity.gov.ph

Ang deadline ng pagbabayad para sa 1st & 2nd quarter business tax ay sa APRIL 30, 2025.