❗️Notice to Taxpayers❗️

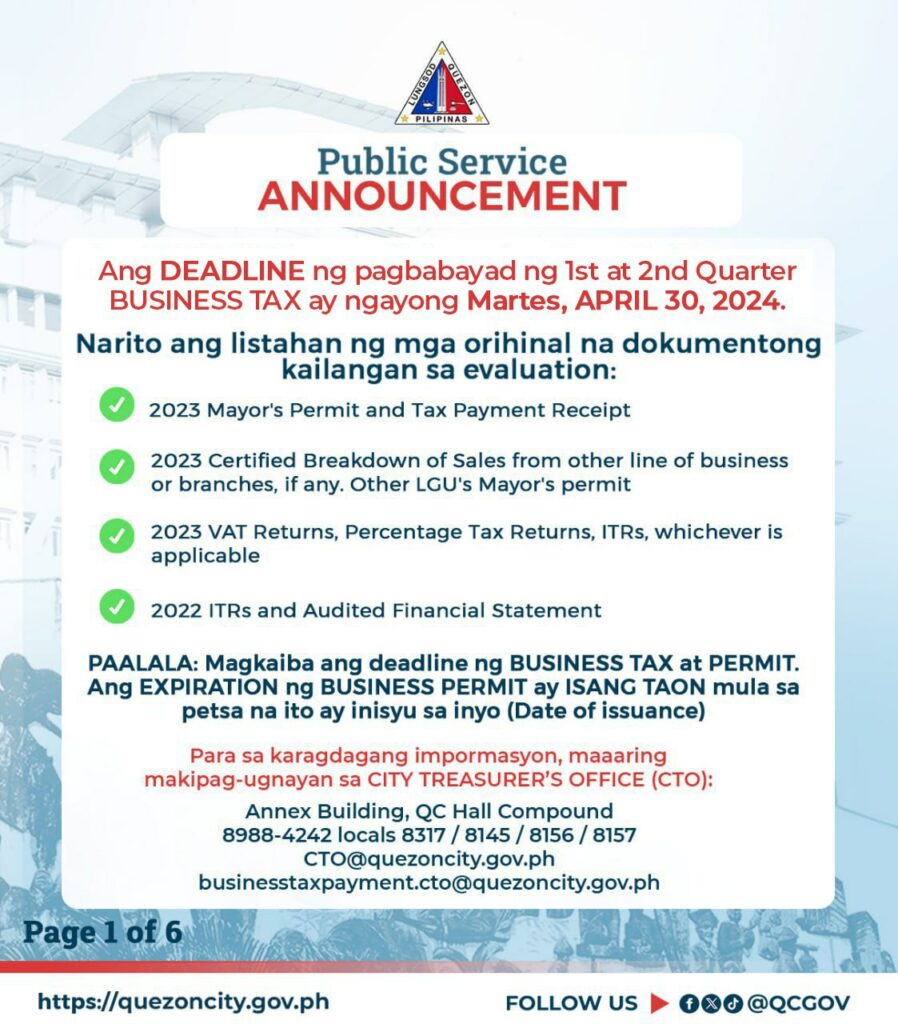

Ang DEADLINE ng pagbabayad ng 1st at 2nd Quarter BUSINESS TAX ay ngayong Martes, APRIL 30, 2024.

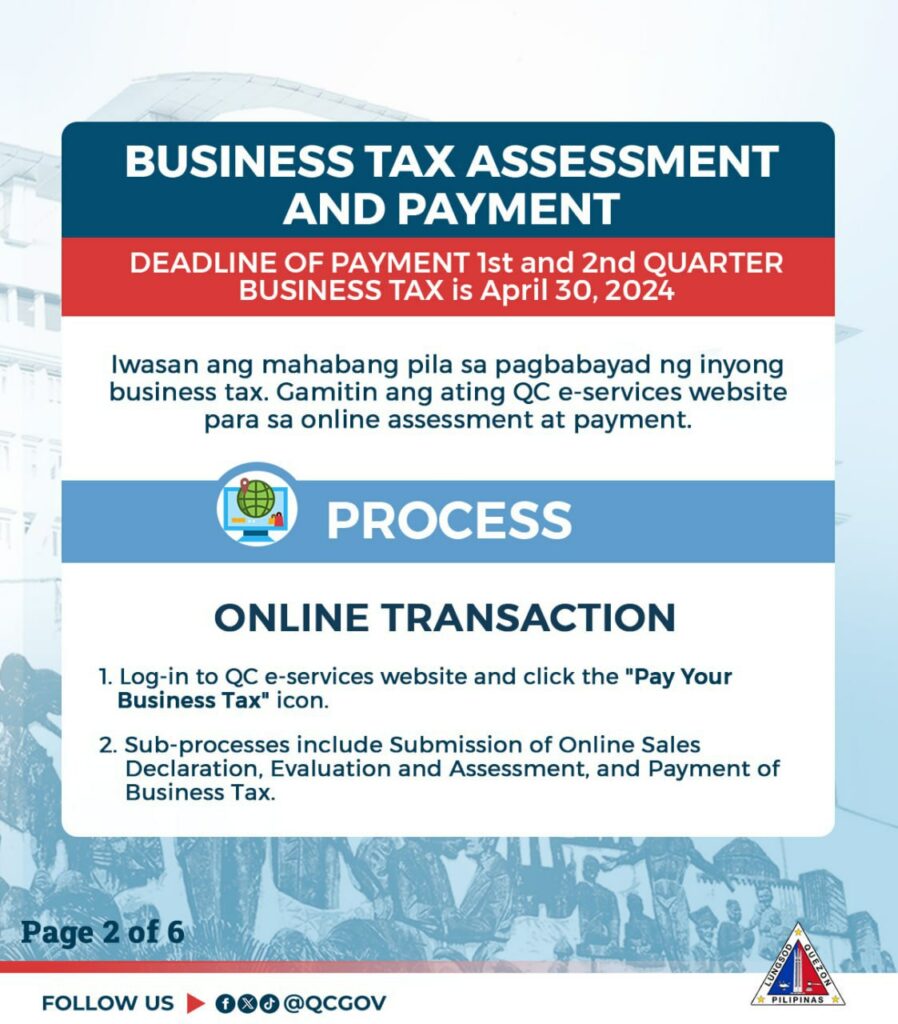

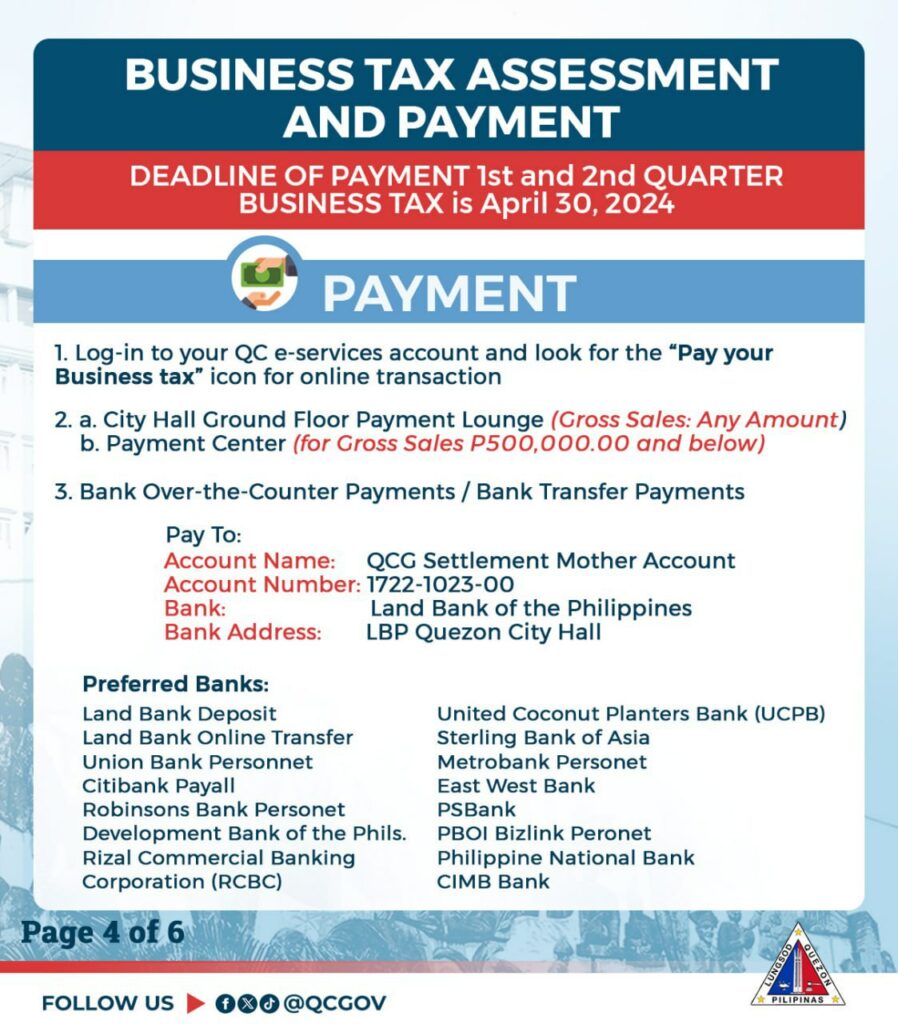

At para maiwasan ang mahabang pila, pwede na rin itong gawin ONLINE! Mag-login lamang sa ating QC E-services website at hanapin ang ‘Pay your Business Tax’ icon para sa online assessment at payment.

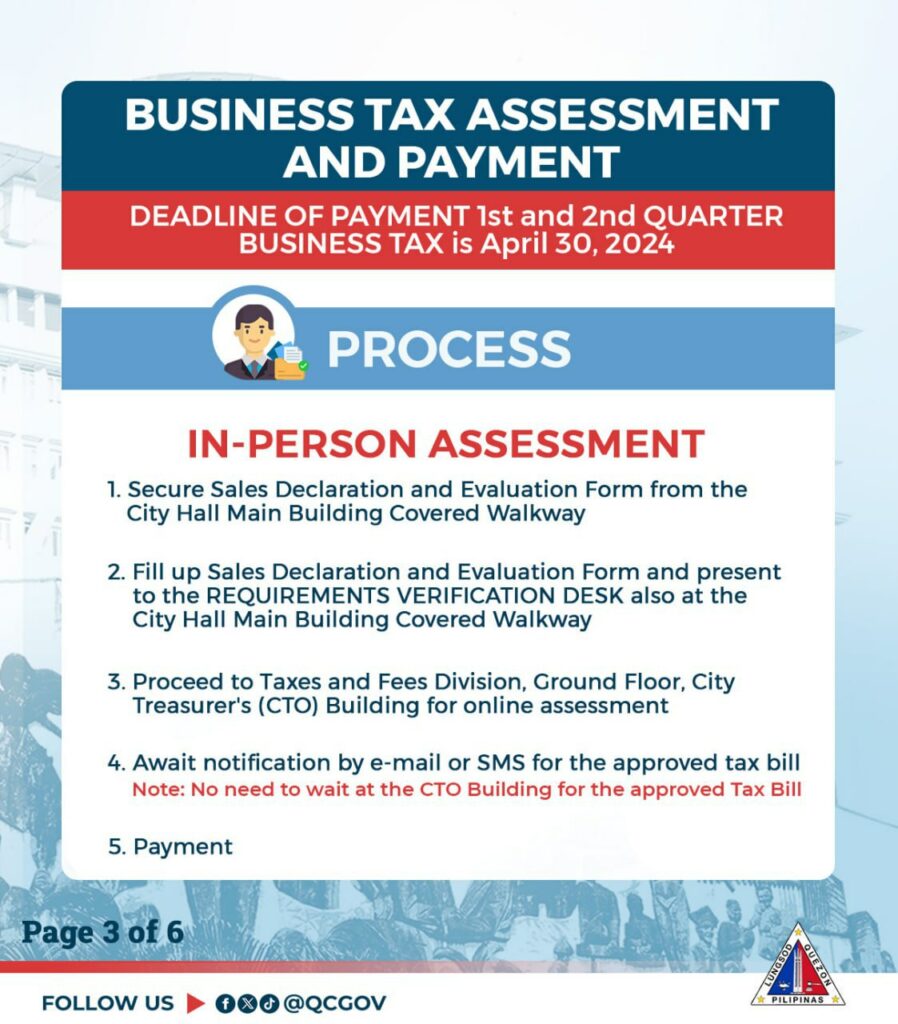

Maaari ring magtungo sa City Hall para sa in-person transaction.

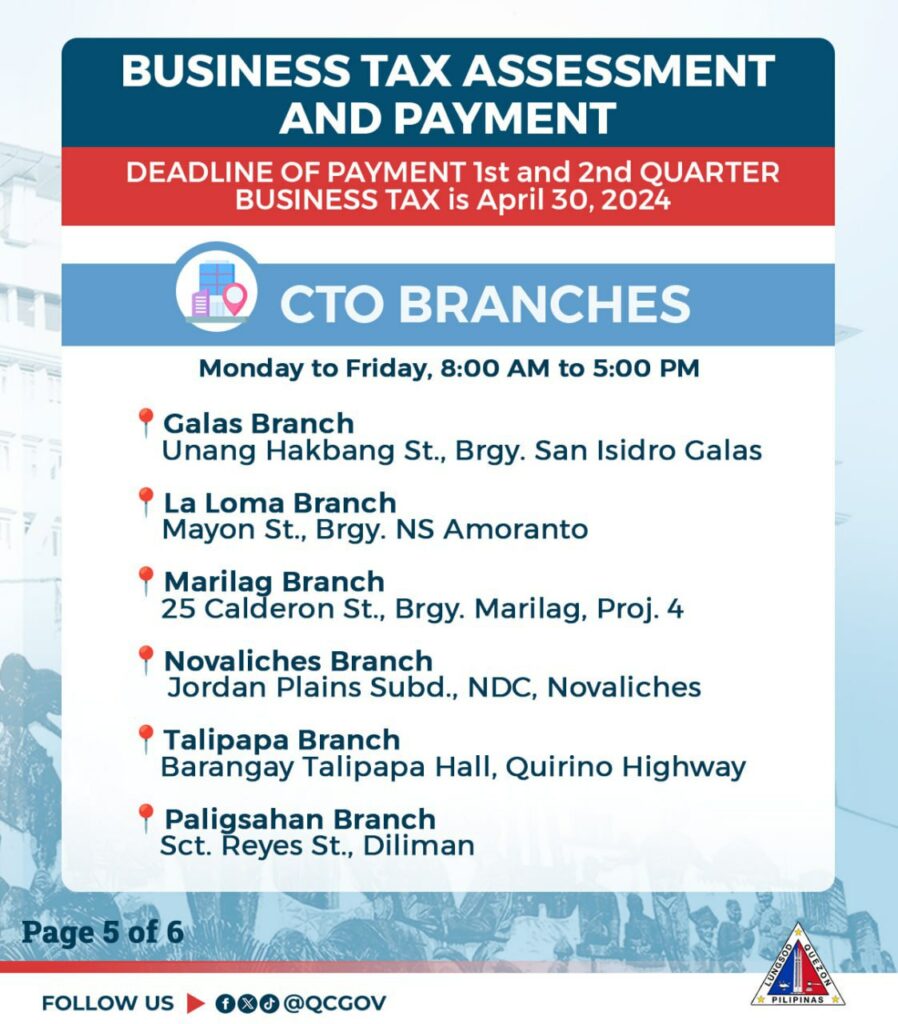

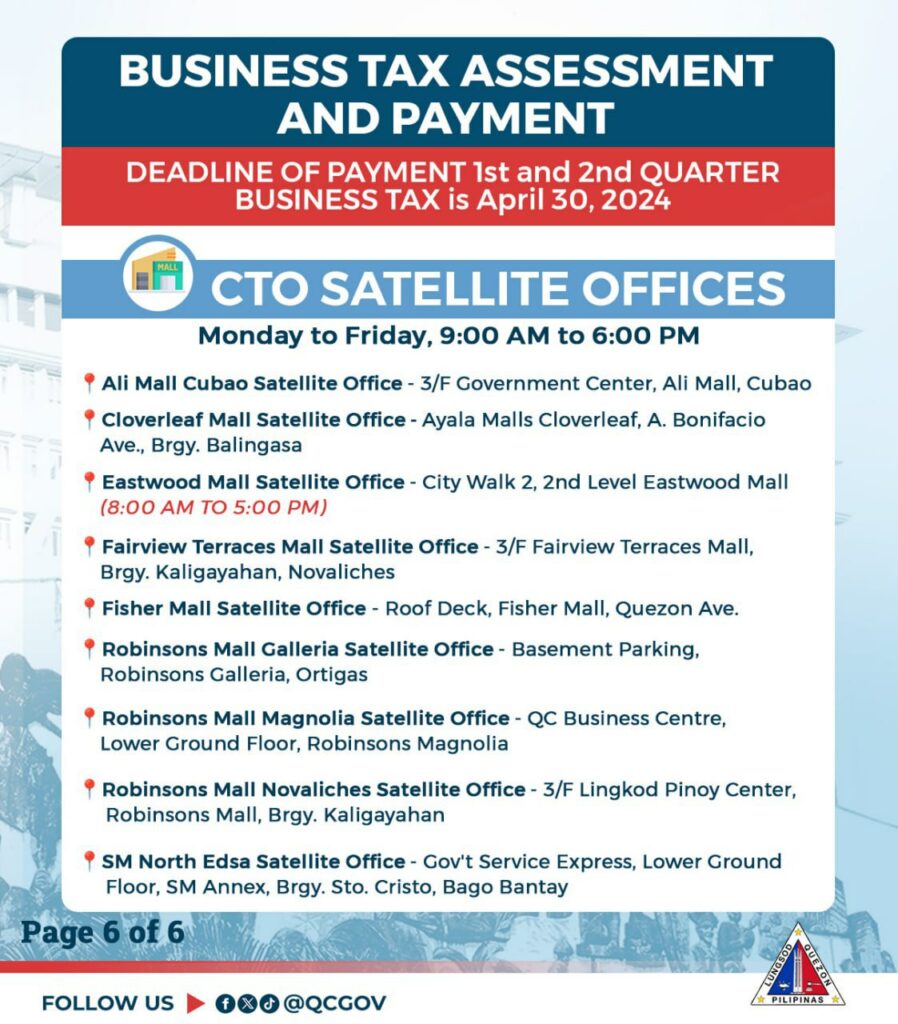

Maaari namang magbayad ng business tax sa mga bangko o sa City Treasurer’s Office branches at satellite offices.

Narito ang listahan ng mga orihinal na dokumentong kailangan sa evaluation:

✅2023 Mayor’s Permit and Tax Payment Receipt

✅2023 Certified Breakdown of Sales from other line of business or branches, if any. Other LGU’s Mayor’s permit

✅2023 VAT Returns, Percentage Tax Returns, ITRs, whichever is applicable

✅2022 ITRs and Audited Financial Statement

Para sa karagdagang impormasyon, maaaring makipag-ugnayan sa CITY TREASURER’S OFFICE (CTO):

Annex Building, QC Hall Compound

8988-4242 locals 8317 / 8145 / 8156 / 8157

CTO@quezoncity.gov.ph; businesstaxpayment.cto@quezoncity.gov.ph