CONTACT INFORMATION

Business Permits and Licensing Department

- BPLD

- Ground Floor, Civic Center Building A, Quezon City Hall, Mayaman St., Barangay Central, Quezon City

- 8988-4242 local 8173

- bpld@quezoncity.gov.ph

- Official Facebook Page of Business Permits and Licensing Department

Official Twitter of the Business Permits and Licensing Department

Official Instagram of the Business Permits and Licensing Department

Office Hours

Monday to Friday

8:00 a.m. to 5:00 p.m.

ABOUT US

Description

The BPLD provides effective and efficient systems, procedures, and practices in issuing and renewing business and occupational permits. BPLD is responsible for regulating the nature and or operations of various business activities within the city.

It is the Department’s duty to conduct inspections on all business establishments operating within the city, ensuring conformity to existing laws, rules, and regulations. Any violations may result in the revocation of permits or licenses and, if necessary, the closure of the business.

Mission

Driven by our desire to make Quezon City the most business-friendly local government unit, the Business Permits and Licensing Department shall provide expeditious and transparent services using advanced technologies through its proficient and dedicated personnel.

Vision

For the Business Permits and Licensing Department to be a leader in providing advanced online systems and streamlined processes in business permitting and licensing at par with global standards.

Legal Bases

- Republic Act No. 7160, otherwise known as the Local Government Code Of 1991

- City Ordinance No. SP-91, S-93, otherwise known as the Quezon City Revenue Code

- Republic Act No. 11032, otherwise known as the Ease Of Doing Business And Efficient Government Service Delivery Act Of 2018

- City Ordinance No. SP-3022, S-2021 as amended by SP-3045, S-2021

Service Pledge

The department commits to providing efficacious, expeditious, transparent, committed, and dedicated service, reinforced by advanced technologies in a customer-friendly and healthy business-focused environment with competent and professional public servants.

Services

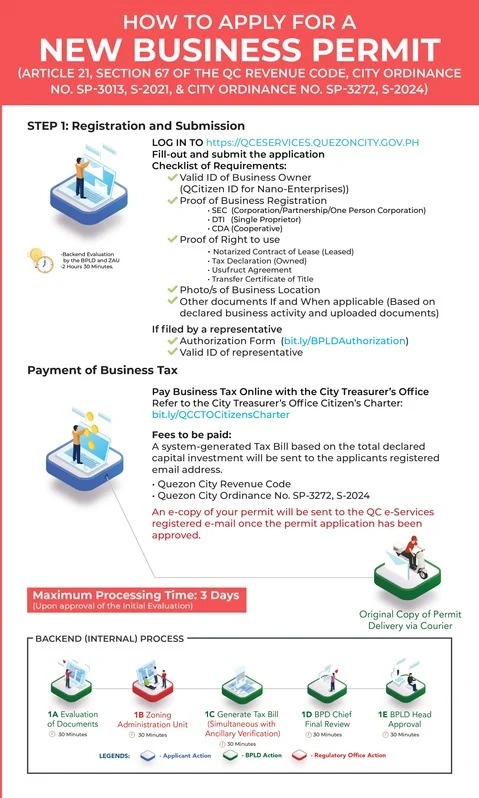

ISSUANCE OF NEW BUSINESS PERMIT

All prospective business owners intending to establish a new enterprise within the city must apply for a New Business Permit.

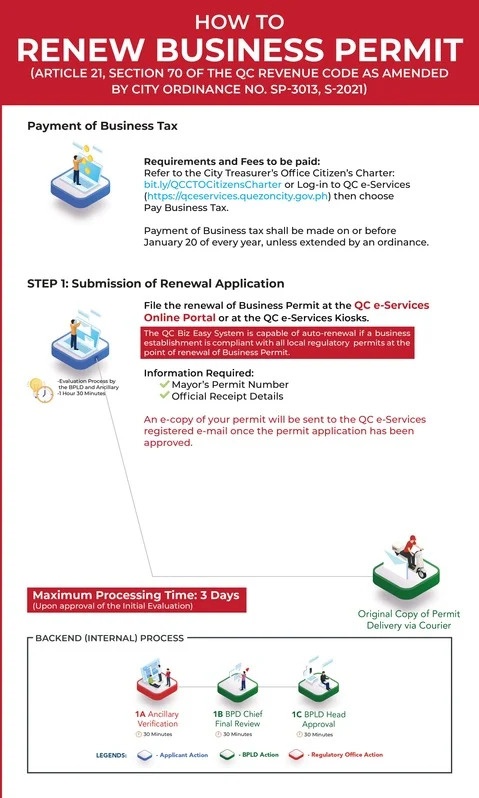

RENEWAL OF BUSINESS PERMIT

Annual renewal of business permits is mandatory for all existing and operational businesses within the city.

AMENDMENT OF BUSINESS PERMIT

The accuracy of business information is not guaranteed to remain constant over time. Businesses may experience changes in location or business activities. Consequently, it is the responsibility of the business owners to submit appropriate amendments to their Business Permit to reflect these modifications.

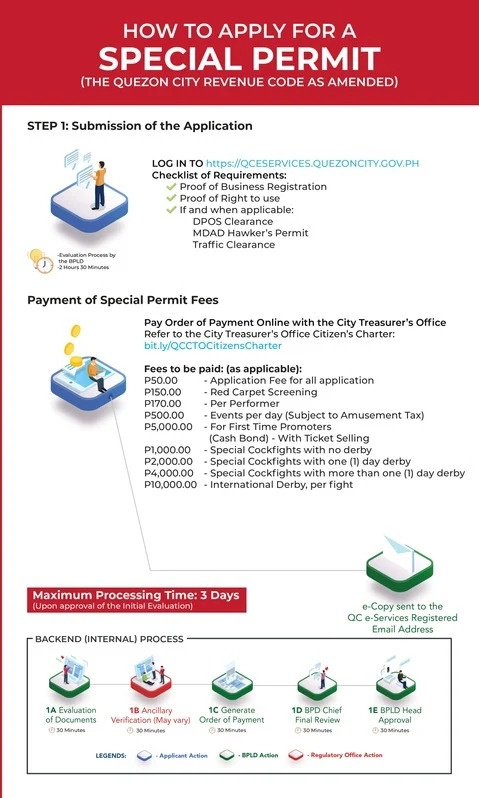

ISSUANCE OF SPECIAL PERMIT

Certain activities or events may be temporary in nature and require prior approval from the Local Government Unit. Examples include concerts, sunday markets, charitable events, or any seasonal activities. Organizers or applicants of such events shall apply for a Special Permit.

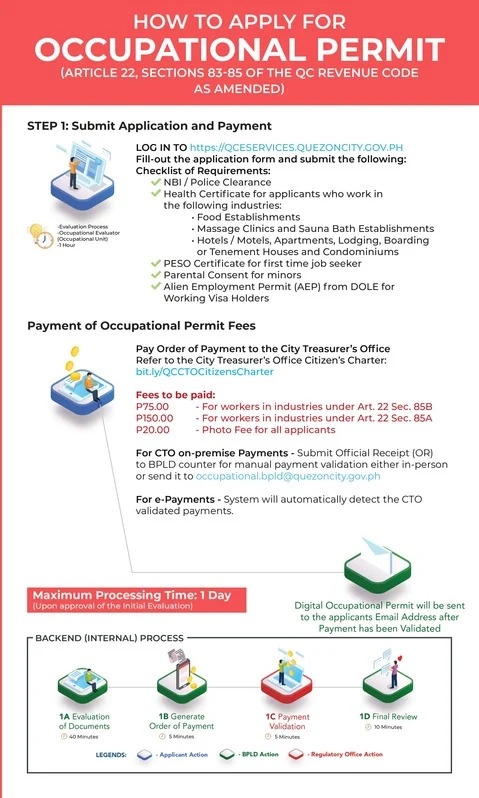

ISSUANCE OF OCCUPATIONAL PERMIT

Individuals seeking or currently engaged in employment within the city are required to apply for an Occupational Permit.

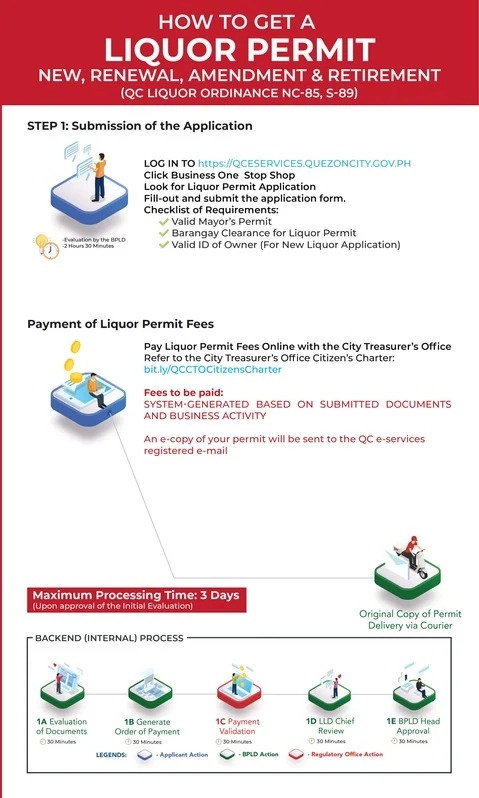

ISSUANCE OF LIQUOR PERMIT

Businesses located in the city that intend to engage in the sale, manufacture, or service of alcoholic beverages are mandated to obtain a liquor permit.

ISSUANCE OF CERTIFICATION OR CERTIFIED TRUE COPY OF BUSINESS PERMIT

These certifications are issued to requesting taxpayers as a prerequisite to availing benefits, renewing licenses, applying for accreditation, and other related purposes.

Programs

AUTOMATIC DOCUMENT DELIVERY SYSTEM (ADDS)

This program is designed to streamline processes and eliminate corruption associated with the release of business permits. As an online platform, it enables real-time tracking of the delivery status of business permits and related clearances. The ADDS ensures that business permits and clearances are delivered promptly and at no cost to the rightful business owners at their registered addresses.

Guides

HOW TO APPLY FOR A NEW BUSINESS PERMIT

HOW TO RENEW BUSINESS PERMIT

HOW TO AMEND BUSINESS PERMIT

HOW TO APPLY FOR A SPECIAL PERMIT

HOW TO APPLY FOR OCCUPATIONAL PERMIT

HOW TO GET A LIQUOR PERMIT

Department Directory

Ms. Ma. Margarita S. Mejia, DPA

City Government Department Head III

bpld@quezoncity.gov.ph

Mr. Michael B. Velasco

City Government Assistant Department Head III

8988-4242 local 8286

assistant.bpld@quezoncity.gov.ph

Divisions/ Sections

| DIVISION | OFFICER NAME | OFFICE ADDRESS | CONTACT INFORMATION |

| Administrative and Finance Division | Mr. Ramon Jesus K. Africa Administrative Officer V | 2nd Floor, Civic Center Building A, Quezon City Hall | 8988-4242 local 8285 admin.bpld@quezoncity.gov.ph |

| BPLD Novaliches District Center | Mr. Joey Dela Cruz Officer In Charge | F. Salvador Street, Jordan Plains Subd., Brgy. Sta. Monica, Novaliches | 8898-8410 local 104 ndc.bpld@quezoncity.gov.ph |

| Business Permit Division | Annie Marie O. Medenilla Licensing Officer V | 3rd Floor, Civic Center Building A, Quezon City Hall | 8988-4242 local 8174 or 8006 bpd.bpld@quezoncity.gov.ph boss.bpld@quezoncity.gov.ph |

| Enforcement and Adjudication Division | Atty. Leo Albert A. Lazo Licensing Officer V | 2nd Floor, Civic Center Building A, Quezon City Hall | 8988-4242 local 8287 legal.bpld@quezoncity.gov.ph |

| Inspection and Verification Division | Primo M. Villafranca Officer in Charge | 3rd Floor, Civic Center Building A, Quezon City Hall | 8988-4242 local 8286 inspection.bpld@quezoncity.gov.ph |

| Liquor Licensing Division | Atty. Bryan G. Pekas Licensing Officer V | 3rd Floor, Civic Center Building A, Quezon City Hall | 8988-4242 local 8433, 8438 liquor.bpld@quezoncity.gov.ph |

| Management Information System, Records and Archiving Division | Ms. Liza H. Africa Records Officer V | 2nd Floor, Civic Center Building A, Quezon City Hall | 8988-4242 local 8284 records.bpld@quezoncity.gov.ph |

Spotlight

SOCIAL MEDIA PLATFORMS

QC E-SERVICES KIOSK (ONE-STOP-SHOP)

AWARD AND RECOGNITION

- Digital Governance Awards – 1st Place QC Delivers: Automated Document Delivery System

- Digital Governance Awards – 2nd Place QC Biz Easy: Online Business Permit Application System

- QC-BPLD Government Best Practice Recognition – QC Delivers: Automated Document Delivery System

- Digital Excellence Awards 2023 – Quezon City Excellence in Driving Digital Impact Award

- Digital Excellence Awards 2023 – Quezon City Excellence in Digital Transformation Award

- ARISE Awards – Quezon City Compliance with the Electronic Business One-Stop Shop (eBOSS)

- Quezon City 2023 Most Business-Friendly LGU Award

E-Services Link

Resources

BPLD CITIZEN'S CHARTER 2025

BPLD CITIZEN'S CHARTER 2024

BPLD CITIZEN'S CHARTER 2023

GUIDELINES FOR FILING REQUESTS FOR RECONSIDERATION