CONTACT INFORMATION

Office of the City Assessor

- OCAs

- Ground Floor, Civic Center Building B, Quezon City Hall, Quezon City

- 8988-4242 local 8185

- cityassessor@quezoncity.gov.ph

Office Hours

Monday to Friday

7:00 a.m. to 5:00 p.m.

About Us

The OCAs are responsible for carrying out real property tax-related functions such as locating all taxable real properties (land, buildings, other structures, and machinery) in the city, identifying and updating ownership, establishing taxable values based on actual use, and applying legal exemptions for exempt properties.

Mission

To ensure accurate, just, equitable, and reliable appraisal and assessment compliant to the City’s thrust for an effective and efficient real property taxation.

Vision

To continually innovate and remain at the forefront in real property taxation and revenue generation through automation, while strengthening linkages to support the delivery of quality services and to promote sustainable development to QCitizens.

Legal Bases

- Section 17, Article V, Republic Act No. 537 (The Revised Quezon City Charter), amended by Section 88, PD 464, (The Real Property Tax Code)

- Section 169, BP No. 337 (The 1983 Local Government Code), amended by Section 454, RA 7160 (The Local Government Code Of 1991)

- Section 472(b), RA 7160

Service Pledge

R – Reliability, dependability, in workforce and assessment records

P – Perseverance, devotion, and dedication to duty

A – Accountability, responsibility, and liable for results and actions

T – Teamwork, the important role and cooperative action of everyone

S – Service excellence with integrity and professionalism

Services

ISSUANCE OF TAX DECLARATION

Tax Declaration (TD) is a document that reflects the value of the real property whether land, building, improvement, or machinery for purposes of real property tax collection, assessed against the owner or taxable person or entity, as authorized under existing laws or ordinances.

It can also be issued for various transactions such as:

- Transfer of Ownership (based on the New Title Issued)

- Consolidation, Subdivision, Segregation Lots, Improvement, or Building

- Consolidation or Segregation with Transfer of Ownership of Real Property

- Consolidation of Ownership of Real Property

- Appraisal and Assessment of New Buildings or Improvements

- Request for Reassessment or Reclassification

- Request for Updating or Revision of values (per existing Ordinances)

- Request for Correction of Entry, Annotation, as may be necessary

- Request for Cancellation of Assessment Record

- Request for Cancellation of Assessment based on Closure or Termination of Business

- Declaration of New or Undeclared Land (Titled Property)

ISSUANCE OF CERTIFICATIONS OF REAL PROPERTY ASSESSMENT DOCUMENTS

- Certified True Copy of Tax Maps – A tax map can be requested to identify the particular location of a property based on the latest Tax Mapping Record, whether manual or Geographical Information System (GIS), and for other purposes. However, this particular certification cannot be used as evidence for setting boundary disputes.

- Certification of Adjoining Lot Ownership – a Certificate of Adjoining Lot Ownership is also issued for purposes of stating the exact location and nearby lot owners within the boundaries of a particular property requested by the owner.

- Certificate of Property Location and Vicinity – a Certificate of Property Location and vicinity is also issued for the purpose of stating the exact location of property based on records available, as part of their due diligence before purchasing a property, land disputes, and for other purposes.

- Issuance of Property Holding Certification (With Property or No Property) and Certification of Improvement (No Improvement or With Improvement) – The OCAs provide a Certificate of Property Holdings or Certificate of No Property Holding upon the request of the owner or his authorized representatives, government agency, or private entity. This service allows the taxpayer to obtain a listing of his or her property holdings as a reference for payment of taxes, and for other legal purposes, it may serve.

- Certificate of No Improvement – provides proof that a certain parcel of land is vacant upon the request of the owner or his or her authorized representative. Should there be an improvement or structure thereon, declared on record, the office will certify the improvement erected on the lot, as per the existing database.

- Counter Verification or Issuance of computer print-out – This is a fast lane service that provides readily available real property information instead of a certified true copy of tax declaration which may be used for paying their real property tax to the Office of the City Treasurer and for other uses it may serve.

- Issuance of Certified True Copy of Tax Declaration – The OCAs provide a Certified True Copy of Tax Declaration upon the request of the owner or his authorized representative, government agency, or private entities, for various reasons, the most common of which are for property transfer-related transactions, as a requirement of BIR, for mortgage, loan, financial institutions, courts, and many other legal purposes.

- There are currently two (2) classifications of TDs being certified –the manual copy or those issued from 2006 and below, manually processed; and the electronic ones which to date can be certified electronically as well.

REAL PROPERTY ASSESSMENT SERVICES

The OCAs continue to maintain the integrity and reliability of the existing real property assessment database by employing established systems and procedures for efficient property verification and identification. Procedures are clear and through the deployment of our Quezon City Real Property Assessment & Taxation System (QCRPATS) hand in hand with the Real Property Dashboard which is another output of the eTAXMAPS project.

PROGRAMS

DEVELOPMENT OF QC: iDeclare Easy

QC: iDeclare Easy is a platform that aims to streamline the processes of securing New Tax Declaration, Certified Copies of Assessment Documents and Certifications, including Tax Clearance, for properties to be transferred, and the computation and payment of Transfer Tax, in compliance with the “Ease of Doing Business and Efficient Government Service Delivery Act of 2018”. We also made it easier for QCitizens and other property owners to verify and check their properties, locate the same, and even verify their last real property tax payment with the introduction of its QCitizen Real Property Viewer.

With just a valid QC E-Services account, you can experience the overall convenience of accessing essential services, in terms of real property-related information, whenever you need, without leaving home.

LAND ADMINISTRATION AND INFORMATION PROGRAM

Deployment of Quezon City Real Property Viewer

QCitizen Real Property Viewer is a customized web-based application deployed last May 9, 2024. QCRPV enables the public to access basic parcel and real property-related information with additional information on real property tax payments, which promotes government transparency. With this application, the users can be able to search available properties based on specific PIN and TCT, Title No., or click on any property on the map.

Deployment of Online Payment Option

The City Government has expanded its payment options for taxpayers planning to settle real property taxes electronically. Through the QC e-Services portal, taxpayers can now pay their current dues using the Maya e-wallet, and credit cards, or by transferring funds from the following banks: RCBC, Robinsons Bank, Union Bank, BPI, and PS Bank.

Community Awareness Program

The OCAs team, led by Atty. Sherry R. Gonzalvo, City Assessor, conducted a voluntary mission to serve the Dumagat Community in the remote areas of Quezon Province.

GUIDES

HOW TO APPLY FOR ISSUANCE OF NEW TAX DECLARATION (Transfer Of Ownership, New Assessment, Segregation/ Consolidation, Correction/ Updating, Annotation) (Collapsible)

STEPS:

1. Download and Fill up forms.

o Transfer of Ownership to view requirements, click here.

o Segregation/Consolidation to view requirements, click here.

o New Assessment/Reassessment of House/Building to view requirements click here.

o Correction/Updating to view requirements click here.

o New Declaration for Land/Titled Property to view requirements, click here.

o Cancellation of Assessment to view requirements, click here.

2. Submit all the necessary documents:

For PROPERTY OWNERS:

Send your properly filled up form together with the complete requirements to our email address: CityAssessor@quezoncity.gov.ph

For AUTHORIZED REPRESENTATIVES/ BROKERS/ SERVICE PROVIDER:

Send your properly filled up form together with the complete requirements and AUTHORIZATION at our email address: CityAssessor@quezoncity.gov.ph

HOW TO REQUEST FOR CERTIFIED TRUE COPY OF TAX MAP OR CERTIFICATION OF ADJOINING LOTS

STEPS:

- Fill up and download your form here or visit our Facebook page: Office of the City Assessor – Quezon City.

- Complete the necessary requirements and submit through our official email, CityAssessor@quezoncity.gov.ph.

- Complete the necessary requirements and submit them through our official email: cityassessor@quezoncity.gov.ph.

NOTE: The applicant will receive an official email notification regarding the acceptance or denial of their application, along with the reasons for the decision.

CERTIFICATION FEES:

Tax Map: PHP 400 per copy

Adjoining Lot Ownership: PHP 100 per copy

CONTACT DETAILS:

Tax Mapping Division

Telephone No: 8988-4242 local 8187/8189

Cell Phone No.: 09054081474/09311270875

HOW TO REQUEST FOR CERTIFICATION OF NO OR WITH IMPROVEMENT, AND PROPERTY HOLDINGS OR PROPERTY VERIFICATION

STEPS:

STEPS:

1. Fill-up and download your form here or visit our Facebook page: Office of the City Assessor – Quezon City.

2. Complete the necessary requirements and submit through our official email, CityAssessor@quezoncity.gov.ph.

o View requirements click here.

- Note: The applicant will receive an email acknowledgement as to acceptance or denial for valid reasons, and you will be informed.

NOTE:

- For HOSPITAL USE:

You can apply thru email CityAssessor@quezoncity.gov.ph or on premise (walk-in). Submit duly accomplished EDP Form (QCG-CAO-QP/SOI-B10-v02), indicating purpose “For Medical Social Service/Hospitalization”; Valid ID and Certification or Medical Abstract from the Hospital concerned at Counter 7, Ground Flr., Civic Center Bldg B, Office of the City Assessor. - ·For SCHOLARSHIP & OTHER PURPOSE:

Kindly send your PROPERLY FILLED UP FORM and VALID ID to our official email address CityAssessor@quezoncity.gov.ph

CERTIFICATION FEES:

For No Improvement: PHP 100 per copy

For with Improvement: PHP 100 per copy

For Property Holdings: PHP 100 per copy plus PHP 20 per additional copy

For No Property: PHP 100 per copy

For Medical Social Service or Hospital use: Exempt

For Property Verification or Issuance of Certification: PHP 100 per copy

Property Research Fee: PHP 50 per property

CONTACT DETAILS

Division Concerned:

Electronic Data Processing Division

Telephone No.: 8988-4242 local 8296

HOW TO REQUEST FOR CERTIFIED TRUE COPY OF TAX DECLARATION

STEPS:

1. Fill-up and download your form here or visit our Facebook page: Office of the City Assessor – Quezon City.

2. Complete the necessary requirements and submit through our official email, CityAssessor@quezoncity.gov.ph.

o View requirements click here.

- Note: The applicant will receive an email acknowledgement as to acceptance or denial for valid reasons, and you will be informed.

Fee for a certified true copy of a tax declaration:

Tax Map: P400 /copy

Adjoining Lot Ownership: P100 /copy

CONTACT DETAILS:

Division Concerned:

Assessment Records Management Division:

Telephone No.: 8988-4242 local 8032/8188

Cellphone No.: 0998 974 9783 (smart), 0965 431 1919 (TM)

DEPARTMENT DIRECTORY

Atty. Sherry R. Gonzalvo

City Assessor

Mezzanine Floor, Civic Center Bldg B, Quezon City Hall, Quezon City

8988-4242 local 8185

cityassessor@quezoncity.gov.ph

Mr. Delfin G. Torres, Jr.

Assistant City Assessor for Operations

2nd Floor, Civic Center Bldg. B, Quezon City Hall, Quezon City

8988-4242 local 8292

delfin.torres@quezoncity.gov.ph

Ms. Priscela B. Verzonilla

Acting Assistant City Assessor for Administration

3rd Floor, Civic Center Bldg. B, Quezon City Hall, Quezon City

8988-4242 local 7304

priscela.verzonilla@quezoncity.gov.ph

Divisions/ Sections

| DIVISIONS | OFFICER NAME | OFFICE ADDRESS | CONTACT INFORMATION |

|---|---|---|---|

| Assessment Records Management Division (ARMD) | Ms. Maria Cecilia M. Castillo Local Assessment Operations Officer IV Acting Head | Ground Floor, Civic Center Bldg. B, Quezon City Hall, Quezon City | 8988-4242 local 8031 to 8032 0998-9749783 0965-4311919 0933-8255392 assessmentrecords.cityassessor@quezoncity.gov.ph |

| Tax Mapping Division (TMD) | Mr. Salvador G. Urbi II Taxmapper V Head | Ground Floor, Civic Center Bldg. B, Quezon City Hall, Quezon City | 8988-4242 local 8187, 8189 0905-4081474 0931-1270875 taxmapping.cityassessor@quezoncity.gov.ph |

| Property Appraisal Division (PAD) | Engr. Jessie G. Avellano Local Assessment Operations Officer IV Officer in Charge | 2nd Floor, Civic Center Bldg. B, Quezon City Hall, Quezon City | 8988-4242 local 8291, 8294, 8295 0931-2077522 0905-5275632 propertyappraisal.cityassessor@quezoncity.gov.ph |

| Electronic Data Processing Division (EDP) | Mr. Yoel M. Tecson Local Assessment Operations Officer V Acting Head | 2nd Floor, Civic Center Bldg. B, Quezon City Hall, Quezon City | 8988-4242 local 8296 0915-4003490 electronicdata.cityassessor@quezoncity.gov.ph |

| Property Valuation Standard Division (PVSD) | Ms. Neil V. Dela Cruz Local Assessment Operations Officer II Acting Head | 3rd Floor, Civic Center Bldg. B, Quezon City Hall, Quezon City | 8988-4242 local 8369 propertyvaluation.cityassessor@quezoncity.gov.ph |

| Administrative Division | Mr. Ricardo B. Masesar Local Assessment Operations Officer V Acting Head | 3rd Floor, Civic Center Bldg. B, Quezon City Hall, Quezon City | 8988-4242 local 8371 0931-2077617 admin.cityassessor@quezoncity.gov.ph |

SPOTLIGHT

OCAs’ YEAR-END REVIEW

To assess the achievements and accomplishments of the office in 2023 and to revisit the target objectives for 2024, OCAs conducts a year-end review activity to align its objectives with Mayor Joy Belmonte’s 14-Point Agenda.

PROJECT CLOSE OUT AND PRESENTATION OF OUTPUT FOR eTAXMAPS PHASE 4

To promote transparency and good governance, the Quezon City Assessor’s Office demonstrated how the public can utilize the QC Real Property Viewer during the project close-out meeting of the Enhanced Tax Mapping Systems (eTAXMAPS) project.

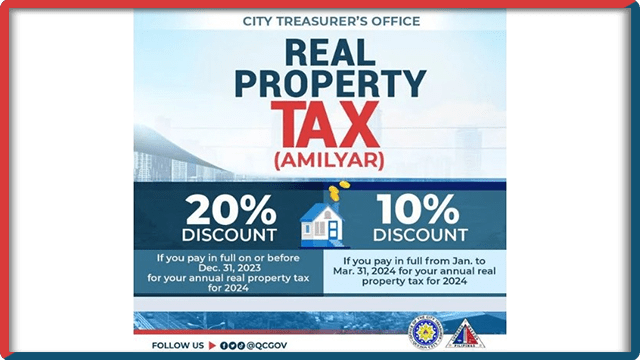

PAYMENT CALENDAR PURSUANT TO ORDINANCE NO. SP-3179, S-2023

DOWNLOADABLE FORMS

Form 101 Transfer of Ownership

Form 102 Segregation/Consolidation

Form 103 New Assessment/Reassessment

Form 105 New Declaration for Land Titled Property

Form 106 Application for Cancellation of New Tax Declaration

Sworn Statement for Land, Building and Machinery

Sworn Statement for Condominium Units

Resources

OCAs CITIZEN'S CHARTER 2025 (1st Edition)

OCAs CITIZEN'S CHARTER 2023 (2nd Edition)

OCAs CITIZEN'S CHARTER 2023 (1st Edition)

OCAs CITIZEN'S CHARTER 2022