CONTACT INFORMATION

City Treasurer’s Office

- CTO

- Annex Building, Mayaman St. Brgy. Central, QC Hall Compound, Diliman, Quezon City

- 8988-4242 locals 8317, 8145, 8156, 8157

- cto@quezoncity.gov.ph

Office Hours

Main Office: Monday to Friday, 8:00 a.m. to 5:00 p.m.

Branch Offices: Monday to Saturday, 8:00 a.m. to 5:00 p.m.

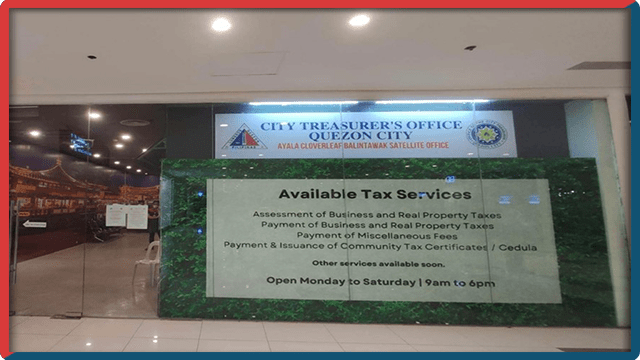

Satellite Offices: Open Monday to Friday, 9:00 a.m. to 6:00 p.m.

ABOUT US

Description

CTO is the main revenue-generating arm of the City, collecting various taxes and fees to support the worthwhile City projects. The CTO is responsible for managing the financial resources of the City Government while ensuring its fiscal growth and stability through improved collection methods and strategies in accordance with the revenue laws and ordinances.

Mission

“ADVOCATE”

To Advance the cause of the Quezon City Government to serve the people.

To Develop organizational capacity to improve performance.

To Venture into innovative strategies in financial management.

To Organize further the Treasury to promote professionalism and specialization.

To Complement the efforts of the local government to provide infrastructure and basic services.

To Assist other Local Government Units through technical assistance.

To Translate the City’s plans and programs for economic growth and self-reliance.

To Empower the Local Treasury through sound fiscal policy and effective financial management.

Vision

To effectively meet the target collection yearly through innovative strategies and methods in financial

management and continually improve the Quality Management System to ensure taxpayer

satisfaction.

Legal Basis

- The existence of the City Treasurer’s Office in a local government unit is based on the provisions of Book II, Section 470 Of Republic Act No. 7160 Otherwise Known As The Local Government Code Of 1991.

Service Pledge

Perform our duties and responsibilities with utmost integrity, competence, and dedication in order to

serve and to meet taxpayer satisfaction.

Pursue our goals objectively to attain office efficiency and meet the target collection to better serve

our constituents.

Attend to all taxpayers or requesting parties who are within the premises of the Office prior to the

end of official working hours and during lunch break.

Services

PAYMENT OF TRANSFER TAX

Quezon City may impose tax on sale, donation or any mode of transferring ownership or title of real property at the rate of not more than Seventy-Five percent (75%) of one percent (1%) of the total consideration involved in the acquisition of the property, or of the fair market/zonal valuation value in case the monetary consideration involved in the transfer is not substantial, whichever is higher. (Sec.135 (a)LGC)

PAYMENT OF CONTRACTORS TAX

Pre-requisite for release of Building Permit.

ASSESSMENT OF BUSINESS TAX (IN PERSON APPLICATION)

Performing proper computation and billing of Business Tax prior to actual payment.

ASSESSMENT OF BUSINESS TAX (ONLINE APPLICATION)

Performing proper computation and billing of Business Tax prior to actual payment

ISSUANCE OF CERTIFIED TRUE COPY, CERTIFICATE OF RECORDS AND

VERIFICATION OF PAYMENT RECORDS FOR BUSINESS ANDTRANSFER TAX

The records, tax delinquency, and verification section maintains, and safekeeping records of payments of business and transfer taxpayers, verifies and identifies the delinquent taxpayers, and monitors the process of determining the tax collectibles. The records include triplicate copies of official receipts issued by the City Treasurer’s Office.

ISSUANCE OF COMMUNITY TAX CERTIFICATE (INDIVIDUAL)

Community Tax Certificate shall be issued to every person or corporation upon payment of the Community tax. A community tax shall be paid in place of residence of the individual or in the place where the principal office of the juridical entity is located. (Art.246 (e) Sec.160, LGC).

ISSUANCE OF COMMUNITY TAX CERTIFICATES (CORPORATION)

Community Tax Certificate shall be issued to every person or corporation upon payment of the Community tax. A community tax shall be paid in place of residence of the individual or in the place where the principal office of the juridical entity is located. (Art.246 (e) Sec.160, LGC).

PAYMENT OF MISCELLANEOUS TAXES & FEES

Collection of regulatory fees and various user/service charges as required by law and imposed by revenue-generating departments of Quezon City.

COLLECTION OF MARKET BUSINESS TAX AND OTHER FEES

Collecting fees from Public and Private Markets and slaughterhouses as per order of payments issued by other revenue-generating departments.

SEALING OF WEIGHTS & MEASURES

Quezon City is empowered to levy fees for sealing weights and measures at such reasonable rates. (Sec. 151 LGC). Every person before using instruments of weights and measures for business, service, commercial, or other transactions with the public within Quezon City shall first have them sealed and pay the corresponding fee, fixed under an ordinance, to the City Treasurer’s Office.

MARKET RAID

Market Raid is an external service of the City Treasurer’s Office conducted to check weighing scales/instruments it is properly sealed or used for illegal purposes by the market vendors.

EXAMINATION OF BOOKS OF ACCOUNTS

Examining books of accounts of business operators in Quezon City to determine the correct gross receipts of the business relative to its declaration in their tax payments.

APPLICATION OF BUSINESS RETIREMENT CERTIFICATE

Business Retirement Certification is issued to business operators that voluntarily or involuntarily discontinue or close their business operations.

ISSUANCE OF REAL PROPERTY TAX CLEARANCE (WALK-IN)

Real Property Tax Clearance is issued to the property owner as proof of complete Real Property tax payment in Quezon City which is provided to a lending company, bank, or personal use.

More details

ONLINE APPLICATION OF REAL PROPERTY TAX CLEARANCE

ASSESSMENT AND BILLING OF REAL PROPERTY TAX

Performing proper computation and billing of Real Property Taxes prior to its actual payment.

COLLECTION OF BUSINESS TAX (WALK-IN)

Business tax payments are collected and validated through the issuance of Computerized Official Receipts.

COLLECTION OF REAL PROPERTY TAX (WALK-IN)

Real Property tax payments are collected and validated through the issuance of Computerized Official Receipts.

CANCELLATION OF BUSINESS AND REAL PROPERTY TAX PAYMENT

Business and Real Property tax payments are collected and validated through the issuance of Computerized Official Receipts. Computerized official receipts (COR) issued within the day can be

canceled for a valid reason.

COLLECTION OF BID DOCS

Bid Docs payments are collected through manually issued Accountable Form No.51 (AF51) as official receipts.

REMITTANCE OF CASH COLLECTION

Bonded Collectors shall prepare the Report of Collection and Deposits (RCD) in 5 copies and remit / turn over intact all collections (cash, checks, and tax credit memos) to the liquidating officers at the Cash Division.

RECORDING OF DAILY TRANSACTIONS IN CASH BOOKS

The Treasurer shall maintain this record to monitor the cash in the bank balance as of a specific date.

All transactions for the day shall be recorded immediately.

RELEASING OF CHECKS PREPARED

Checks approved and signed by the different signatories are being released. Official

Receipts from different contractors or suppliers by the City Government are strictly required.

RELEASING OF FINANCIAL ASSISTANCE FOR THE BEREAVED FAMILY OF

DECEASED SENIOR CITIZEN

The QC Death Benefits Welfare Assistance is a financial assistance program of the city government for the bereaved family of senior citizens of the city in accordance with the City Ordinance SP-2544, series of 2016. The application for this financial assistance should be within three (3) months AFTER the death of the QC-resident Senior Citizen.

RELEASING OF QUEZON CITY LIVING CENTENARIAN RECOGNITION AWARDS AND BENEFITS

Those legitimate city residents aged 100- years and older will receive benefits of ₱100,000.00 (one time), a monthly allowance of ₱1,000.00, an annual birthday gift of ₱1,000.00 from the paymasters at the cash division’s windows

RELEASING OF SALARIES OF CONTRACTUAL AND/OR JOB ORDER EMPLOYEES THAT HAS NO ATM CARDS

Those new employees of certain departments of the Quezon City Hall that have no issued ATM cards should proceed to the Cash Division’s paymasters to get their salaries.

RELEASING OF CHECK AS FINANCIAL ASSISTANCE TO THE DECEASED

GOVERNMENT OFFICIALS

This program provides immediate intervention to individuals and families who are in crisis situation or economic difficulties brought about by illness or hospitalization through the procurement of medicines not readily available at the Pharmacy of the QC Health Department, or the death of a family member through the extension of Guarantee Letters to funeral parlors within the City to defray the cost of funeral service.

RELEASING OF FINANCIAL BURIAL ASSISTANCE

This program provides immediate intervention to individuals, or the death of a family member through the extension of Guarantee Letters to funeral parlors within the City to defray the cost of funeral service.

RELEASING OF BARANGAY SHARES FROM REAL PROPERT TAX (RPT) AND

COMMUNITY TAX COLLECTIONS (CTC)

All Barangay are entitled to receive their share from CTC and RPT quarterly as one of their source of income.

COLLECTION OF PAYMENT FROM BENEFICIARIES OF SOCIALIZE HOUSING

PROJECT

The Account Management and Monitoring section issues orders of payment to beneficiaries of the Socialize Housing Program who will pay their monthly amortizations.

ONLINE PAYMENT PROCESSING OF NEW BUSINESS

The Account Management and Monitoring section issues orders of payment to beneficiaries of the Socialize Housing Program who will pay their monthly amortizations.

ONLINE PAYMENT PROCESSING OF ANNUAL BUSINESS TAX (RENEWAL)

The Account Management and Monitoring section issues orders of payment to beneficiaries of the Socialize Housing Program who will pay their monthly amortizations.

ONLINE PAYMENT PROCESSING OF OCCUPATIONAL PERMIT

ONLINE PAYMENT PROCESSING OF LIQUOR PERMIT

ONLINE PAYMENT PROCESSING OF REAL PROPERTY TAX

ONLINE PAYMENT PROCESSING OF BUILDING PERMIT

ONLINE PAYMENT PROCESSING OF PROFESSIONAL TAX RECEIPT (PTR)

ONLINE PAYMENT PROCESSING OF HEALTH CERTIFICATE

ONLINE PAYMENT PROCESSING OF SANITARY PERMIT

COLLECTION OF AMUSEMENT TAX

The Quezon City may levy an amusement tax to be collected from the proprietors, lessees, or operators of theatres, cinemas, concert halls, circuses, boxing stadia, and other places of amusement. (Sec.140 (a), LGC)

ISSUANCE OF ACCOUNTABLE FORMS

Every accountable officer of the local government unit whose duties permit or require the custody of funds, property/ accountable forms shall be covered by a fidelity bond and such officer shall be accountable and responsible for said funds and property/ accountable forms and for the safekeeping thereof in conformity with the provisions of law. (Sec.305 (f), LGC; Sec.101, PD No. 1445)

RECEIVING INCOMING CORRESPONDENCE

The receiving and dissemination of the official documents such as memoranda, letters, or correspondence from other Offices or Agency addressed to the City Treasurer’s Office for information, compliance, or claim of the requesting party

ONLINE APPLICATION/RENEWAL OF FIDELITY BOND

The application or renewal of the fidelity bond is being processed online.

BRANCHES / SATELLITE OFFICES EXTERNAL SERVICES

ASSESSMENT OF BUSINESS TAX

Performing proper computation and billing of Business Tax prior to actual payment

COLLECTION OF BUSINESS TAX

Business tax payments are collected and validated through the issuance of computerized Official receipts

ISSUANCE OF COMMUNITY TAX CERTIFICATE (INDIVIDUAL)

Community Tax Certificate shall be issued to every person or corporation upon payment of the Community tax. A community tax shall be paid in place of residence of the individual or in the place where the principal office of the juridical entity is located. (Art.246 (e) Sec.160, LGC)

ISSUANCE OF COMMUNITY TAX CERTIFICATES (CORPORATION)

Community Tax Certificate shall be issued to every person or corporation upon payment of the Community tax. A community tax shall be paid in place of residence of the individual or in the place where the principal office of the juridical entity is located. (Art.246 (e) Sec.160, LGC)

PAYMENT OF MISCELLANEOUS TAXES& FEES

Collection of regulatory fees and various user/ service charges as required by law and imposed by revenue-generating departments of Quezon City.

COLLECTION OF MARKET BUSINESS TAX AND OTHER FEES

Collecting fees from Public and Private Markets and slaughterhouses as per order of payments issued by other revenue-generating departments.

Guides

HOW TO PAY YOUR DUES AND TAXES

REQUIREMENTS:

Bring complete documents to avoid any delay in transactions. Documents include:

- Accomplished Sales Declaration and Evaluation Form

- Previous year’s Business Permit

- Previous year’s Tax Bill and Official Receipt of Business Tax Payment

- Previous year’s Breakdown of Sales (if there are two or more lines of businesses/ two or more branches

- Previous year’s Value Added Tax Returns or Percentage Tax Returns (whichever is applicable)

- Annual Income Tax Returns with a complete set of Audited Financial statement with proof of payment from 2 years ago

STEPS:

- Secure Sales Declaration and Evaluation Form from the City Hall Main Building Lobby or Download here.

- Fill out Sales Declaration and Evaluation Form and present to the REQUIREMENTS VERIFICATION DESK also at the City Hall Main Building Lobby

- Secure approval/signature of Business Tax Bill from the Office of the City Treasury located at the second floor.

- Payment: There are two ways to pay:

- City Hall Payment at the G/F Payment Lounge or any Payment Center (for Gross Sales P500,000.00 and below)

- Online Payment at QCeServices website

- GCash (electronic Official Receipt / Invoice ready)

- Maya e-Wallet

- Visa / Mastercard Debit or Credit Card (via Maya)

- PayGate (BPI, UnionBank, RCBC etc.)

HOW TO CLOSE A BUSINESS IN QC

The process of closing or what is commonly known as retiring a business is accomplished through both the local and national government. The retiring of a business at the BIR, SEC, and DTI levels must be done through the respective units. Retiring of a business at the Barangay and LGU levels can be facilitated through this website.

REQUIREMENTS:

- Formal letter of intent to close business addressed to the City Treasurer’s Office copy furnished the Business Permits and Licensing Department

- Original copies of Tax Bill and Official Receipts worth 3 years

- Original copy of Latest Business Permit

- If Single Proprietorship, original Affidavit of Closure with the exact date of closure.

- If Partnership, original partnership dissolution with exact effectivity date of closure signed by all partners.

- If Corporation, original Secretary’s Certificate or Board Resolution on closure or transfer of the business with the exact date of closure.

- Valid ID (present original and submit photocopy)

- If a Single Proprietorship, the valid ID of the owner

- If a Partnership, valid IDs of all partners

- If Corporation, a valid ID of the President

- Barangay Certificate with exact effectivity date of closure. The Barangay Clearance and Certificate of Closure can be requested from the Barangay by submitting a Letter of Request for Retirement (possibly clickable leading to a sample template of the letter).

- BIR Certificate of Registration (present original and submit photocopy)

- Certified Breakdown of Sales, if there are two (2) or more lines of businesses/branches and if AFS is consolidated

- Proof of business tax payment / tax bill / permit issued by the other LGU where other operations are situated (present original and submit photocopy)

- Latest ITR with AFS on or before closure from the last payment of business operation (present original and submit photocopy)

- VAT Returns or Percentage Tax Returns (present original and submit photocopy)

- Book of Accounts (to be presented upon evaluation/ actual inspection and examination)

Estimated processing time: 3 to 7 days.

NOTE: If you have not completed the process of business closure or retirement, this means the business is still operational. And if your business is still in operation, and does not comply with the requirements, you will be penalized accordingly.

HOW TO GET A COMMUNITY TAX CERTIFICATE (CEDULA) FOR INDIVIDUAL

Community Tax Certificate or Cedula is issued to a person or corporation upon payment of the Community tax. A community tax is paid in place of residence of the individual or in the place where the principal office of the juridical entity is located.

SINGLE

REQUIREMENTS:

- Accomplished Community Tax Declaration Form (CTDF) (from City Treasurer’s Office)

- Government-issued valid ID

- Proof of Income

- Payslip

- BIR form 2316

- For representative:

- ID of the representative

- Authorization Letter with a photocopy of a government-issued valid ID of the person being represented

STEPS:

- The taxpayer should accomplish the CTDF.

- Proceed to the counter intended for encoding of information.

- Pay the required amount (depending on the income of the taxpayer) and receive the computerized CTC.

NEW BUSINESS

REQUIREMENTS:

- Accomplished Community Tax Declaration Form (CTDF) (from City Treasurer’s Office)

- Government-issued valid ID

- Single proprietor certificate of registration

- For representative:

- The ID of the representative

- Authorization Letter with a photocopy of the government-issued valid ID of the person being represented

STEPS:

- The taxpayer should accomplish the CTDF.

- Proceed to the counter intended for encoding of information.

- Pay the required amount (depending on the income of the taxpayer) and receive the computerized CTC.

RENEWAL OF BUSINESS

REQUIREMENTS:

- Accomplished Community Tax Declaration Form (CTDF) (from City Treasurer’s Office)

- Government-issued valid ID

- Proof of Income (Approved business tax declaration by an evaluator from City Treasurer’s Office)

- For representative:

- ID of the representative

- Authorization Letter with a photocopy of the government-issued valid ID of the person being represented

STEPS:

- The taxpayer should accomplish the CTDF.

- Present the approved business tax declaration by an evaluator.

- Proceed to the counter intended for encoding information.

- Pay the required amount (depending on the income of the taxpayer) and receive the computerized CTC.

CLAIMING OF PAID CTC- SINGLE PROPRIETOR

REQUIREMENTS:

- Accomplished Community Tax Declaration Form (CTDF) (from City Treasurer’s Office)

- Government-issued valid ID

- The original tax bill and official receipt (Duplicate or pink copy of official receipts)

- For representative:

- ID of the representative

- Authorization Letter with a photocopy of the government-issued valid ID of the person being represented

STEPS:

- The taxpayer should present original tax bill and duplicate or pink copy of official receipts.

- The CTO personnel will search the Mayor’s Permit number through the system and print CTC based on the presented documents.

- The taxpayer will receive the computerized community tax certificate.

HOW TO GET A COMMUNITY TAX CERTIFICATE (CEDULA) FOR CORPORATION

Community Tax Certificate or Cedula is issued to a person or corporation upon payment of the Community tax. A community tax is paid in place of residence of the individual or in the place where the principal office of the juridical entity is located.

NEW BUSINESS

REQUIREMENTS:

- Accomplished Community Tax Declaration Form (CTDF) (from City Treasurer’s Office)

- Government-issued valid ID

- Certificate of Registration

- For representative:

- The ID of the representative

- Authorization Letter with a photocopy of the government-issued valid ID of the person being represented

STEPS:

- The taxpayer should accomplish the CTDF.

- Proceed to the counter intended for encoding of information.

- Pay the required amount (depending on the income of the taxpayer) and receive the computerized CTC.

BUSINESS RENEWAL

REQUIREMENTS:

- Accomplished Community Tax Declaration Form (CTDF) (from City Treasurer’s Office)

- Government-issued valid ID

- Proof of Income (Approved business tax declaration by an evaluator from City Treasurer’s Office)

- For representative:

- ID of the representative

- Authorization Letter with a photocopy of a government-issued valid ID of the person being represented

STEPS:

- The taxpayer should accomplish the CTDF.

- Present the approved business tax declaration by an evaluator.

- Proceed to the counter intended for encoding of information.

- Pay the required amount (depends on the income of the taxpayer) and receive the computerized CTC.

CLAIMING OF PAID CTC- SINGLE PROPRIETOR

REQUIREMENTS:

- The original tax bill and official receipt (Duplicate or pink copy of official receipts)

- Accomplished Community Tax Declaration Form (CTDF) (from City Treasurer’s Office)

- Government-issued valid ID

- For representative:

- ID of the representative

- Authorization Letter with a photocopy of a government-issued valid ID of the person being represented

STEPS:

- The taxpayer should present the original tax bill and a duplicate or pink copy of official receipts.

- The CTO personnel will search the Mayor’s Permit number through the system and print CTC based on the presented documents.

- The taxpayer will receive the computerized community tax certificate.

HOW TO RENEW OR AMEND BUSINESS PERMITS

THE NEW NORMAL: UNIFIED PERMIT APPLICATION PROCESS

STEPS:

- Settle your 2020 business tax dues with the City Treasurer’s Office. Kindly check the process here: PAYING YOUR DUES AND TAXES

- Register or log in to QC E-Services and choose Business One Stop Shop to submit a copy of the latest business tax OR and previous Mayor’s Permit online or by appointment.

- Wait for notification via email to claim your renewed permit or have it delivered via courier of your choice.

HOW TO APPLY FOR REAL PROPERTY TAX CLEARANCE (ONLINE)

REQUIREMENTS:

- Application form (download and fill up)

- Updated Tax Declaration

- Updated Official receipt of Real Property Tax

- S.P.A or Authorization letter, Secretary Certificate (Corporation or Company) if not declared as Real Property owner

- If a real property owner:

- 4.1 If Owner, 1 government-issued ID

- 4.2 If Property has been bought but the Tax Declaration is still under the previous owner, submit a copy of the Deed of Sale and 1 government-issued ID of the buyer

- 4.3 If the owner is deceased, Extrajudicial Settlement and 1 government-issued ID of requesting party

- If a real property owner:

STEPS:

- Fill out the online application form attached with complete requirements and send it to this

- email address: realestate.cto@quezoncity.gov.ph

- Review tax payments

- If short/adjustment taxes are found, we will notify you immediately

- If there are no back taxes, proceed to the next step

- Send order of payment

- Once the payment is made it will reflect on the following day

- Printing of Tax Clearance

- Signature of designated Officer

- Send the claim stub with the confirmation email

CLAIMING

Print the confirmation email and claim stub then submit it to the 2nd Floor Treasury Building, Real Estate Division, Tax Clearance Section together with (1) a photocopy of any government-issued ID of the applicant and the authorized person to pick up

RELEASING

Three (3) working days after payment acknowledgment email from the miscellaneous section

NOTE: For Ten (10) or more tax clearances you may apply directly at the Office

HOW TO APPLY FOR REAL PROPERTY TAX CLEARANCE (WALK-IN)

REQUIREMENTS:

- Unified Application Form

- Updated Tax Declaration (1 photocopy)

- Updated official receipt of Real Property Tax (1 photocopy)

- S.P.A /Authorization letter, secretary certificate (corporation/company) if not declared as a Real property owner (1 photocopy)

- If owner, 1 government-issued ID (1 PHOTOCOPY)

- If the property has been bought but the Tax Declaration is still under the previous owner, submit a copy of the Deed of Sale and one government-issued ID of the buyer (1 photocopy each)

- If the owner is deceased, Extrajudicial Settlement and one government-issued ID of requesting party (1 photocopy)

- The previous copy of Tax Clearance acquired (if available) 1 photocopy/duplicate copy)

STEPS:

- Submit accomplished Unified Application Form and other documentary requirements at the 2nd floor Treasury Building, Real Estate Division, Tax Clearance Section

- Payment-Tax Clearance fee (PHP 50 per Tax Clearance for each tax declaration)

- Claim stub with a follow-up date

- Review tax payments

- If short/adjustment taxes are found, notification will be sent via SMS contact no stated in the application form

- Printing of Tax Clearance

- Signature of the designated officer

Claiming

Present claim stub to releasing officer

Releasing

With previous Tax Clearance (1 day)

New Application or no attached previous clearance (3 working days)

Ten (10) or more Tax Clearance (5 working days)

Department Directory

Mr. Edgar T. Villanueva

Department Head, City Treasurer

8988-4242 local 8157

ed.villanueva@quezoncity.gov.ph

Divisions / Sections

| DIVISIONS | OFFICER NAME | OFFICE ADDRESS | CONTACT INFORMATION |

|---|---|---|---|

| Administrative Division | Ms. Carmelita P. Dar Acting Chief Administrative Officer and Conc. Head-Property and Supplies Unit | 3rd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8375, 8376 admin.cto@quezoncity.gov.ph |

| Administrative Division | Mr. Paul John Pablo Head, Personnel Section | 3rd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8319 admin.cto@quezoncity.gov.ph |

| Administrative Division | Ms. Lorina S. Sarmiento Head, Records Section | 3rd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8320 admin.cto@quezoncity.gov.ph |

| Administrative Division | Mr. Arvin Philip M. Gotladera Head, Fiscal Verification Section | 3rd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8342 admin.cto@quezoncity.gov.ph |

| Administrative Division | Ms. Maritoni V. Lauzon Head, Accountable Forms Unit | 3rd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8301 admin.cto@quezoncity.gov.ph |

| Cash Division | Ms. Maria Rosanna S. Santos Chief, Cash Division | Ground Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8155, 8156 cashdivision@quezoncity.gov.ph |

| Cash Division | Ms. Juliet V. Peralta OIC-Head, Cash Disbursement Section | Ground Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8144 cashdivision@quezoncity.gov.ph |

| Cash Division | Mr. Norman Asistores Head, Taxpayers’ Payment Lounge | Ground Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8139, 8140 cashdivision@quezoncity.gov.ph |

| Examination Division | Ms. Lorenza L. Seva OIC- Examination Division and Conc. Head Business Retirement Unit | 2nd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8265 examination.cto@quezoncity.gov.ph |

| Examination Division | Atty. Amando L. Ipac, Jr. Deputy Head, Business Retirement Unit | 2nd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8266 examination.cto@quezoncity.gov.ph |

| Financial Management Unit (FMU) and Online Payment Group | Mr. Aristotle K. Cristobal System / Database Administrator (Online Payment Group) | 3rd Floor Annex Building, Quezon City Hall Compound | 8988-4242 locals 8269, 8270 businesstaxpayment.cto@quezoncity.gov.ph misctaxpayment.cto@quezoncity.gov.ph RPTPayment@quezoncity.gov.ph |

| Legal Services Unit | Atty. Karlo Calingasan Acting Legal Officer, Legal Services Unit | 2nd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8264 legal.cto@quezoncity.gov.ph |

| Real Estate Division | Ms. Annie P. Santiago Chief, Real Estate Division | 2nd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8145 realestate.cto@quezoncity.gov.ph |

| Real Estate Division | Ms. Carissa S. Aquino Assistant Head, Real Estate Division | 2nd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8145 delinquency.cto@quezoncity.gov.ph |

| Real Estate Division | Mr. Levy G. Mercado Acting Head, Tax Delinquency Section | 2nd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8268 delinquency.cto@quezoncity.gov.ph |

| Real Estate Division | Ms. Rowena M. Cena Acting Head, Tax Clearance Section | 2nd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8297 realestate.cto@quezoncity.gov.ph |

| Real Estate Division | Mr. Paul Vincent G. Silva Acting Section Chief, Assessment Lounge- Real Property Tax | Ground Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8177 rptassessment.cto@ quezoncity.gov.ph |

| Taxes and Fees Division | Ms. Rosernie L. Santos Assistant Chief, Taxes and Fees Division and Acting Head of Residence Tax Section | Ground Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8263 taxes.cto@quezoncity.gov.ph |

| Taxes and Fees Division | Ms. Carolyn G. Bastasa Head, Tax Delinquency, Verification, and Records Section | 2nd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8262 taxes.cto@quezoncity.gov.ph |

| Taxes and Fees Division | Ms. Gloria M. Perez Acting Head, Miscellaneous Fees Section | Ground Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8141 taxes.cto@quezoncity.gov.ph |

| Taxes and Fees Division | Mr. Dionisio Sanin Jr. Head, Market Collection Section | 2nd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8175 taxes.cto@quezoncity.gov.ph |

| Taxes and Fees Division | Mr. Enrique Donasco Jr. Head, Calibration, Weights, and Measures Section | 3rd Floor Annex Building, Quezon City Hall Compound | 8988-4242 local 8267 taxes.cto@quezoncity.gov.ph |

BRANCH OFFICES

| BRANCH | OFFICER NAME | OFFICE ADDRESS | CONTACT INFORMATION |

| Marilag | Ms. Gloria A. Guevara Deputy Treasurer | 25 Calderon St., Brgy. Marilag, Project 4, | 7005-0881 |

| Galas | Ms. Rita M. Cortez Deputy Treasurer | Unang Hakbang St., Brgy. San Isidro | 7005-5996 |

| La Loma | Ms. Cecilia D.O. Tolentino Deputy Treasurer | Mayon St., (near Police Station) | 0917-5387227 |

| Novaliches District Center | Ms. Angela P. Sapiandante Deputy Treasurer | Jordan Plains Subd., NDC, Novaliches | 7254-7296 |

| Paligsahan | Mr. Albert M. Evangelista II Acting Deputy Treasurer | 65 Scout Reyes St., Diliman | 8898-8420 local 404 |

| Talipapa | Ms. Arlene Carreon Deputy Treasurer | Brgy. Hall Talipapa, Quirino Hi-way, Novaliches | 7118-7725 |

SATELLITE OFFICES

| SATELLITE | OFFICER NAME | OFFICE ADDRESS | CONTACT INFORMATION |

| Ali Mall | Ms. Maria Victoria O. Santos Acting Deputy Treasurer | 3rd Floor Gov’t. Center, Ali Mall, Cubao | 8988-4242 local 8320 |

| Ayala Malls Cloverleaf | Mr. Marlon R. Manalang Acting Deputy Treasurer | Ayala Malls Cloverleaf, A. Bonifacio Brgy. Balingasa, Quezon City | 7275-6627 |

| Eastwood City | Ms. Bibiana L. Soriano Acting Deputy Treasurer | City Walk 2, 2nd Level East Mall | 8988-4242 local 8320 |

| Fairview Terraces | Ms. Ma. Crizelda C. Garia Deputy Treasurer | 2nd Floor Fairview Terraces, Quirino Highway corner Maligaya Drive, Pasong Putik | 7002-5536 |

| Fishermall | Mr. Ricardo M. Dueñas Deputy Treasurer | Roof Deck, Fisher Mall, Quezon Ave. | 0915-249-1654 |

| Robinsons Galleria | Ms. Jocelyn T. Castro Acting Deputy Treasurer | QC Business Centre, Basement 2 EDSA Node, Robinson’s Galleria, Ortigas | 0977-1056556 |

| Robinson Magnolia | Ms. Eloisa C. Estella Acting Deputy Treasurer | QC Business Centre, Lower Ground Floor, Robinson’s Magnolia | 8988-4242 local 8320 |

| Robinsons Novaliches | Ms. Edna Tacadena Acting Deputy Treasurer | 3rd Floor Lingkod Pinoy Center, Robinson’s Mall, Brgy. Kaligayahan, Novaliches | 7359-4182 |

| SM North Edsa | Ms. Cristina S. Sanin Deputy Treasurer | Gov’t Service Express, Lower Ground Floor, SM Annex, Brgy. Sto. Cristo, Bago Bantay | 8988-4242 local 8320 |

CALENDAR OF ACTIVITIES

| SCHEDULE | EVENT/ACTIVITY NAME | |

| MONTH | TENTATIVE DATE / EXACT DATE | |

| Every 20th of the Month | 20 | Deadline of Payment of Amusement Tax |

| Every 20th of the Month | 20 | Deadline of Payment of Market Fees |

| JANUARY | 31 | Deadline of Payment of Professional Tax |

| FEBRUARY | 28 | Deadline of Payment of Individual and Corporate Community Tax Certificates |

| MARCH | 8 | City’s Women’s Month Celebration |

| MARCH | 31 | Deadline of Payment of Real Property Tax for the 1st Quarter |

| APRIL | 30 | Deadline of Payment of Business Tax for the 1st and 2nd Quarter |

| JUNE | 30 | Deadline of Payment of Real Estate Tax for the 2nd Quarter |

| JULY | 20 | Deadline of Payment of Business Tax for the 3rd Quarter |

| SEPTEMBER | 30 | Deadline of Payment of Real Property Tax for the 3rd Quarter |

| OCTOBER | 20 | Deadline of Payment of Business Tax for the 4th Quarter |

| OCTOBER | 30 | Trick or Treat |

| NOVEMBER | 18 | Gift Giving at Holy Trinity for Children |

| DECEMBER | Last Working Day of December | Deadline of Payment of Real Estate Tax for the 4th Quarter |

Spotlight

INAUGURATION OF SATELLITE OFFICES

Inauguration of the CTO Satellite Office in Robinsons Magnolia Mall

Opening Date: December 12, 2020

Inauguration of the CTO Satellite Office in Fisher Mall

Opening Date: December 12, 2020

Mayor Joy Belmonte, together with City Treasurer Edgar Villanueva and CTO personnel at the opening of the CTO Satellite Office in the QC Business Center at Ali Mall

Opening Date: November 16, 2019

Mayor Joy Belmonte with City Treasurer Edgar Villanueva and CTO personnel at the CTO Satellite Office at Robinsons Novaliches Satellite Office.

Opening Date: November 16, 2019

Opening of the CTO Satellite Office in the QC Business Centre at Ayala Malls, Fairview Terraces

Opening Date: February 15, 2020

Opening of the CTO Satellite Office in the QC Business Centre at Robinsons Galleria

Opening Date: February 15, 2020

CTO Eastwood City Satellite Office at City Walk 2, 2nd Level East Mall at Eastwood City

CTO Satellite Office at Ayala Malls Cloverleaf, A. Bonifacio Brgy. Balingasa, Quezon City

CTO Paligsahan Branch at 65 Scout Reyes St., Diliman, Quezon City

CTO Marilag Branch at 25 Calderon Street Brgy.Marilag, Quezon City

Digitalization of QC Taxpayers

Digitalization of QC Taxpayers is an online payment option for taxpayers to pay their business and real property tax.

QC e-Services Kiosk Machine of the City Treasurer’s Office

E-service Kiosks Machine is used for filing and renewal of business permits and to avoid long lines and unnecessary face-to-face interaction inside the City Treasurer’s Office. This can be located at Quezon City Hall and other satellite offices.

Downloadable forms

Application Form – Sealing And Licensing Of Weights And Measures

Application for Registration Form (Amusement)

Amusement Tax Return With No Tickets

Application for Business Retirement -Corporation

Application for Business Retirement – Partnership

Application for Business Retirement – Sole Proprietor

Resources

CTO CITIZEN'S CHARTER 2025

CTO CITIZEN'S CHARTER 2024

CTO CITIZEN'S CHARTER 2023

CTO CITIZEN'S CHARTER 2020

EXTENDED DEADLINE (SP-3064, S-2021)

WAIVED PENALTIES (SP-3068, S-2021)

STAGGERED SETTLEMENT (SP-3069, S-2021)